What are Research and Development tax credits and can I claim them for my business? This guide for Northern Ireland SMEs will show where you may be eligible.

What are Research and Development tax credits and can I claim them for my business? This guide for Northern Ireland SMEs will show where you may be eligible.

We’ll explain the Credits and how the Relief works, then see how the scheme is doing in Northern Ireland before looking in detail at what kinds of projects and which costs will qualify for the Relief.

For more information and to apply for this Relief, get in touch with us at jb@johnbarfoot.co.uk.

R&D Tax Credits

The R&D tax credit scheme is the Government’s way of rewarding innovative businesses that are developing new, or appreciably improving existing, products, processes, systems and materials, and thereby creating jobs and increasing the country’s wealth creation capacity. Companies that incur costs in developing such products, processes or services can apply for a cash payment or tax deduction.

The Government has expressed its desire to make the UK the most attractive place to start and invest in innovative companies, and as a result the incentives for companies to innovate have continued to improve. The European Commission recently confirmed the UK’s advantage in this area, highlighting the UK in their 2014 report on R&D tax incentives as one of the case studies of best practice in terms of eligibility of expenditure, organisation and novelty requirements.

Research and development tax credits are not an aggressive tax planning measure, they are credits that the Government is actively encouraging companies to apply for, as innovation in business supports economic prosperity.

How does HMRC R&D Tax Relief work? Here are the facts…

R&D tax credits are a relief on corporation tax, and are open to limited companies of any size. They’re known as an enhanced allowance, which means you get relief on more than you’ve actually paid. In April 2015, the Government further increased the relief available to SMEs to 230% (previously 225%). This means that for every £10,000 that your business spends on Research and Development, HMRC will allow £23,000 off your taxable profit. At the current corporation tax rate, this represents an additional tax relief of £2600 on every eligible £10,000 of expenditure.

For a profitable SME an R&D claim would reduce its profits chargeable to corporation tax for the period, by the amount of the additional deduction. Where this will create a loss for corporation tax purposes, the SME will then have to decide whether to

- carry back the loss to the previous accounting period (assuming there is a taxable profit)

- carry the loss forward and offset against future profits (as and when they arise) at the normal tax rate

- and/or to cash in the loss and accept a payable R&D tax credit from HMRC

There is no stipulation from HMRC as to how this payout must be spent.

Any claim for R&D Relief will be made in your Company Tax Return or amended return. The normal time limit for making your claim is 2 years after the end of the relevant Corporation Tax accounting period. Once your claim has gone in, HMRC has 28 days to pay back or make an enquiry.

How much has been claimed?

Interest in this scheme has been steadily increasing since the credits were first introduced in the tax year 2000-1. Up until 2012-13 (the most recent accounting period for which figures are available) over 28,500 SMEs and 7,000 Large Companies had made a total of 100,000 claims, and received more than £9.5 billion in tax relief and payable credits. Most of these claims are made by companies with registered offices in London, the East of England and the South East (47% of all claims made and 65% of total amount claimed). In 2012-13, Northern Ireland-based firms’ claims made up less than 2% of the total amount paid out by HMRC.

R&D in Northern Ireland

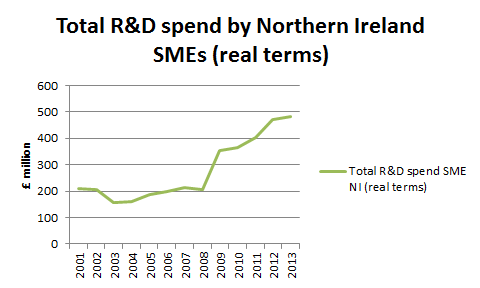

Northern Ireland SMEs have been increasing their Research and Development investment, with real-terms spending rising from £207.8 million in 2000-1 to £481.8 million in 2012-13. See the growth in this graph:

Acknowledging Northern Ireland’s already ‘outstanding’ record in research and development, Arlene Foster, Northern Ireland’s (then) Minister for Enterprise, Trade & Investment, is keen for more local businesses to optimise for R&D. Ms Foster says:

‘We must continue to build on this and make R&D an integral part of the region’s business culture. Through the development of new products and processes, or the improvement of existing ones, new lucrative opportunities can be opened up that may not otherwise have been available.’

In the 2015 Budget (March), the Government announced that it would introduce new standalone guidance aimed specifically at smaller companies, backed by a 2 year publicity strategy to raise awareness of R&D tax credits. This has just been published and includes plans to provide special help for first time claimants, to publish bespoke guidance for small businesses, and by 2017 to begin actively identifying and contacting companies who may be eligible for R&D tax credits but who have not yet made any claim.

It’s expected this will further increase uptake in all regions. There is no doubt, however, that regions outside London and the South East have the most ground to make up in the coming years.

Why don’t Northern Ireland firms apply for R&D Relief?

While many Northern Ireland-based firms have made successful claims to HMRC (270 claims paying out approx. £10 million in just the most recent financial year), businesses here are repeatedly called out as being massively under-represented in this kind of funding.

Partly this is because NI business owners may not be aware of the scheme. Or they may share the common misconception that R&D is only available to companies who are involved in formal lab research – pharmaceuticals, robotics and so on – when it is in fact open to any company that is contributing to innovative practices in their respective industry (more on that below). Finally, business owners are busy running their businesses, and simply don’t have time to look into the process of making a claim. They’re not sure where to turn for advice, and they don’t fancy getting on the wrong side of HMRC if they make a mistake and their claim is denied.

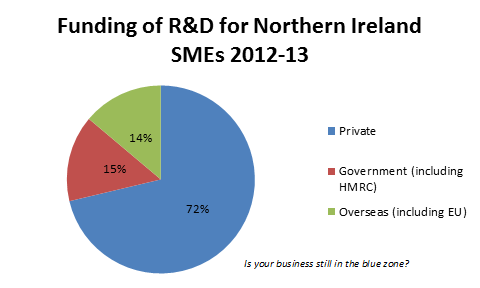

The result is that most companies in Northern Ireland self-fund their Research and Development

work. In 2012-13, self-funding accounted for 72% of R&D work in Northern Ireland SMEs (statistics published by DETINI in December 2014). Government provided less than 15% of R&D funding and overseas grants provided less than 14% (see the pie chart, right). Even allowing that the definition of R&D for HMRC purposes is narrower than the commercial definition, this still leaves huge potential for Northern Ireland companies to claim for HMRC funding.

Is your business still in the blue zone?

Who can apply for HMRC R&D Tax Relief?

Research and development has a specific definition for the purposes of R&D Relief which is not the same as the commercial meaning. To qualify for R&D Relief, you need to show that your company’s team of experienced professionals is working on a project that involves tackling a scientific or technological uncertainty.

This can include creating new processes, products or services, making appreciable improvements to existing ones and even using science and technology to duplicate existing processes, products and services in a new way. As such, there is no restriction on the industry in which you work. Companies as diverse as medical care, manufacturing, engineering, automotive, communications, health and social work and software development have all benefited from this Relief.

That’s companies:

- developing or creating new or improved products/processes

- making advancements in their field of work

- employing technical staff, engineers, software developers or scientists

- that consider themselves to be technically innovative

- that spend any money on development work

How do I know if my company is carrying out R&D?

Research and development is carried out in projects. Each project will have a specific aim (e.g project to increase nutrient value of pet food) and a clear start and end date. Your company may be running several such projects concurrently, with staff and other resources overlapping, but each claim will be for just one project. For HMRC R&D Tax Relief, a project has to satisfy three criteria:

- It’s making an advance

- It’s overcoming technical uncertainties

- It’s not readily deducible

Let’s look at each of these in more detail.

-

Making an advance

The advance can apply to a product, process, service or device. Your business could be increasing productivity or developing new products or processes. But the advance does not have to be ground-breaking (e.g. launching the next Google or the latest in renewable energy findings). You might be aiming to duplicate an existing product/process in an appreciably improved way – this may be making something faster, cheaper, lighter, smaller or higher quality.

The advance can be tangible (e.g. smaller device) or intangible (e.g. cost saving), as long as it is in overall knowledge to your industry (it’s ok if someone else is working on this and hasn’t found a solution, and you may use someone else’s research as a starting point). A project that merely brings about advancement in the organisation’s own capability would not be sufficient.

The point is that you’re trying to improve something that your industry could benefit from, and spending money in doing so.

-

Overcoming technological uncertainties

The projects cannot be based around known knowledge – there must be technical ‘blind alleys’ involved: How will X react with Y? Will X offer the correct physical properties? Can X and Y be combined to produce Z? These may be uncertainties of cost, space, regulation, or of complexity of combining two systems, but they can’t be minor or routine.

Consider also your staff – do you employ a technical director/manager? He is in all likelihood carrying out R&D. Or maybe you have no knowledge internally but you sub-contract someone for these purposes – the sub-contacting costs are allowable.

-

Not readily deducible

The improvement you’re seeking should be more than minor or routine upgrading, and a solution should not be common knowledge. Consider whether a competent professional working in your field would recognise the difficulty in the advancement you’re trying to achieve. Would they be able to readily resolve your problem? If a solution would not be obvious to a competent professional, then you may have an eligible project. Pure product development in itself will not qualify, as the point of the project has to be the advance in technology or scientific knowledge.

R&D work for tax relief purposes begins when work to resolve the uncertainty starts, and ends when that uncertainty is resolved or the work to resolve it ceases. And remember, R&D is work to resolve a scientific or technological uncertainty aimed at achieving an advance in science or technology. Aimed = you don’t have to actually get there, and aborting a project is fine. As a general rule, projects should last at least 3 months, as this demonstrates a degree of technical difficulty.

It is particularly important that the people doing the work are involved when considering whether the project is R&D for tax purposes as they are the ones who understand best the scientific or technological problems involved. They should focus on what advances the project is seeking to achieve and the uncertainties to be faced rather than on the eventual product aspiration, specification or design.

Some examples of successful claims to HMRC

- A ready meal company made a successful claim on their research into creating a sauce that didn’t develop a skin

- A pet food company made a more nutritious pet food

- An engineering firm developed a material to protect workers from harmful gases

- Development of iPad and iPhone applications

Which costs qualify for R&D Relief?

To qualify as R&D, any activity must meet the definitions set out by the Department for Business, Innovation and Skills. Their guidelines state that the activity must contribute directly to seeking the advance in science or technology or must be a qualifying indirect activity.

If your company and the project both meet the necessary conditions, then you can claim tax relief on revenue expenditure (generally, this means costs incurred in the day-to-day running of the business – not capital expenditure on assets) in the areas outlined below, if all necessary conditions are met.

Your R&D project, especially in smaller businesses, will rarely be neatly packaged with designated staff members, machinery and so on. You may well have overlapping projects going on in your business at one time. If you have spent money on something such as staff costs where the employee was only partly engaged on R&D activities, you can still claim for an appropriate proportion of the cost.

HMRC defines four categories of qualifying costs:

- Direct labour i.e. staff on payroll who are working on the project

- External staff, directly employed on the project

- R&D consumables

- R&D subcontracted expenditure

Extra costs such as software licences and utilities are also allowable.

Direct labour – that is, employing staff directly who are actively engaged in carrying out R&D itself. You can claim for salaries, wages, class 1 NIC and pension fund contributions for staff directly and actively engaged in the R&D project. The staff must be employed under a contract of employment directly with your company or organisation – not consultants, agency workers, or staff/directors whose contracts of employment are with other companies. However, these others may qualify under either the rules for staff providers or subcontractors. Support staff costs, for example administrative or clerical staff, do not qualify, except where they are engaged in the qualifying indirect activities laid out in HMRC guidelines.

External staff – paying a staff provider for staff provided to the company who are directly and actively engaged in carrying out R&D. The staff provider needs to contract with the individual whose services they supply – not through another person.

Consumables – consumable or transformable materials used directly in carrying out R&D. These are actual physical materials that are consumed in the R&D, and not things like telecommunication or data costs. Telephone, rent and rates are excluded as these are not consumed. Materials used in the construction of products to be sold are also not allowable.

Subcontracted R&D expenditure – if your company or organisation is claiming relief under the SME Scheme, then you may be able to claim back 65 per cent of what you spend on certain R&D activities carried out for you by a subcontractor. Under the SME Scheme the subcontractor does not need to be a UK resident and there is no requirement for the subcontracted R&D to be performed in the UK. Large Companies can only claim expenditure on activities that are undertaken directly on its behalf by certain specific kinds of subcontractor.

A company may also claim for payments to clinical trials volunteers – the cost of relevant payments to subjects of clinical trials; utilities – power, water and fuel used directly in carrying out R&D and computer software used directly in the R&D. Where software is only partly employed in direct R&D, an appropriate apportionment should be made.

Non-qualifying costs include the production and distribution of goods and services, patents, overheads, travel and capital expenditure (other relief is available here).

Capital Expenditure

Although R&D Relief is only available for revenue expenditure (generally, day-to-day running costs), you may be able to claim R&D capital allowances such as plant, machinery and buildings used for R&D activity.

What if I want to apply for another subsidy or grant?

As well as HMRC tax credits, research and development may be funded through self/private investment and grants. Self-funding is the most common (of course this is how you are inevitably funding your R&D unless you have applied for funding elsewhere!) and private funding is used frequently by business. There are also grants available from various government enterprise agencies (such as Invest NI) and the EU.

If your company or organisation has received a subsidy or grant for an R&D project, this may affect how much tax relief you can claim. If the subsidy or grant is a ‘state aid’ recognised by the European Commission, then you can’t claim anything under the HMRC SME Scheme. For any other type of subsidy or grant, the R&D expenditure you can claim for is reduced by the amount of subsidy or grant received. However, SMEs may also claim relief under the Large Company scheme if they cannot claim under the SME scheme because of a grant or other subsidy.

How do I claim?

If you’d like a professional opinion on whether your business might qualify for this HMRC Relief or you wish to discuss the possibilities for obtaining your HMRC repayment, get in touch with us. We will help you to put your claim together, either as a stand alone project or as part of a wider tax planning service. Our R&D work is carried out on a no win, no fee basis, and our initial discovery period is complimentary. To get started, phone 028 796 31343 or email jb@johnbarfoot.co.uk.