There has been an increase in fraudsters targeting email addresses with promises of tax rebates. HMRC will never contact you about a rebate by email (or text message), only by official letter. Never click on any links in suspicious emails, proclaiming to be from HMRC. DO … [Read more...]

Chancellor’s Budget Summary March 2017

Summary of the main announcements in the Spring Budget, 8th March 2017 The Chancellor confirmed that the individual personal allowance will increase to £11,500 for 2017/18 from the current rate of £11,000. The Higher Rate Threshold will rise by £2,000. This means … [Read more...]

George moves the business goal posts – Changes to taxation of dividends for small business directors

The recent Finance Bill contains a number of changes that will adversely affect small businesses across the UK. From 6th April 2016, the shareholder directors of small businesses will likely see a reduction in their take home pay as a result of changes in the 2016 Finance … [Read more...]

Who can apply for R&D tax credits? Examples of successful claims

Taking our clients' claims and those we've found in our research, we've created an extended list of examples of successful claims made to HMRC for Research and Development tax credits, categorised by area of industry. We'll add to these as we file or learn of more cases. See … [Read more...]

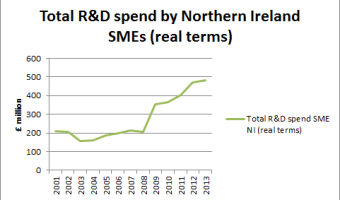

Research and Development Tax Credits

What are Research and Development tax credits and can I claim them for my business? This guide for Northern Ireland SMEs will show where you may be eligible. We'll explain the Credits and how the Relief works, then see how the scheme is doing in Northern Ireland before … [Read more...]